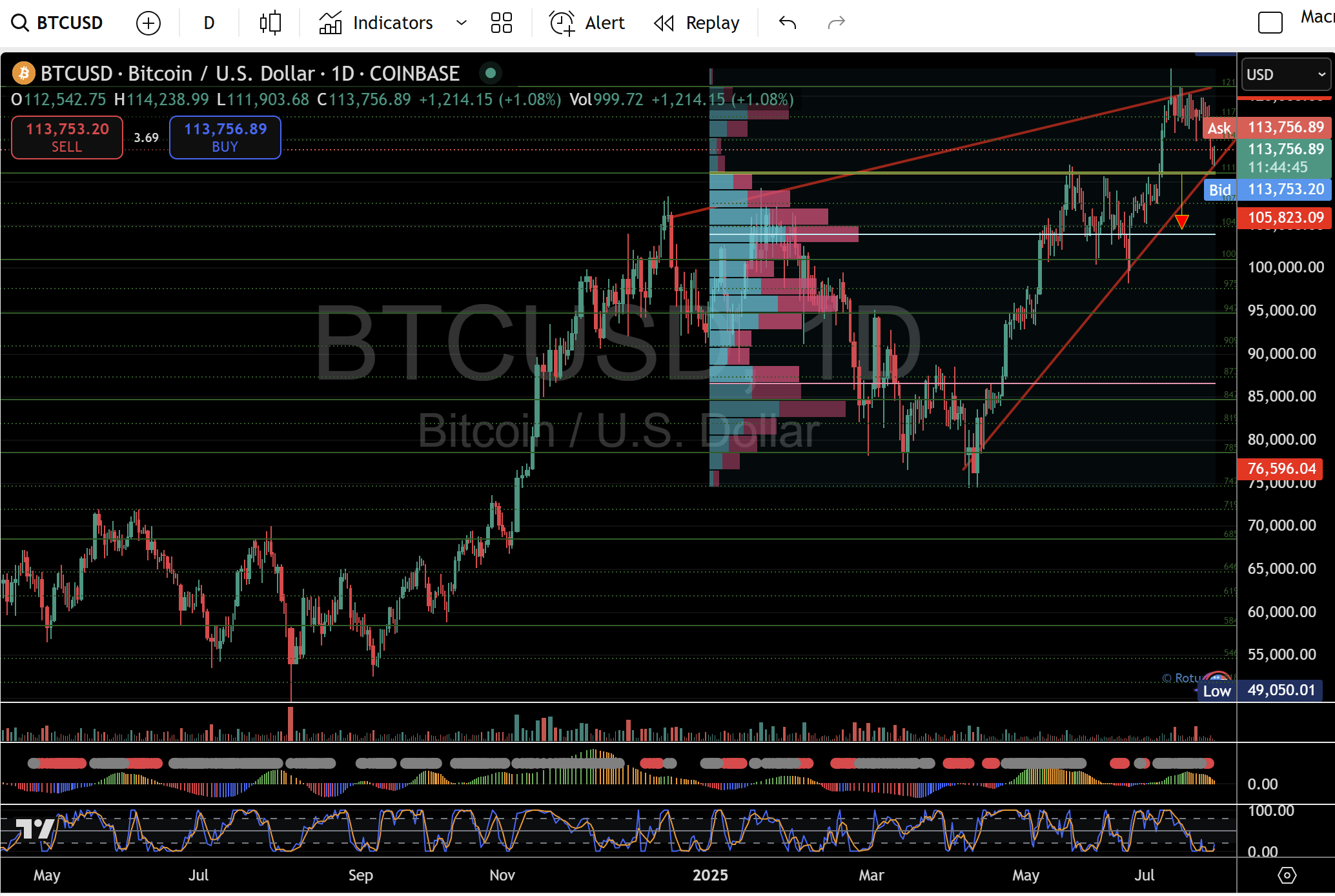

BTC/USD has coiled into a year-long rising wedge, retreating from the $121 000 peak and now clinging to its $111 000 “line in the sand”—a decisive break there could spark a drop toward $100 000, while a successful hold may fuel one last thrust back toward $121 000 and beyond.

Over the past twelve months, Bitcoin has been trading inside a well-defined rising wedge (higher highs and higher lows converging toward the top). In July, BTC stalled at the $121,000 resistance and has since retraced to test the lower trend line and the annual Value Area High (VAH) around $111,000—a pivot that now carries outsized importance.

- Volume profile context:

- The high-volume node between $ 100,000 and $ 95,000 acts as strong support if $ 111,000 gives way.

- Above current prices, there is a relative liquidity void from $115,000 to $120,000, indicating that a break higher could accelerate quickly toward new highs.

- Momentum and squeeze indicators:

- The TTM Squeeze histogram displays dwindling momentum bars, indicating the exhaustion of the rally.

- Daily stochastic has rolled over from overbought territory, reinforcing the risk of a deeper retracement if wedge support fails.

Crucial levels to watch

- “Line in the sand” – $111 000

- Holds here → wedge remains intact, fresh leg toward $114 865, $117 596, and retest of $121 000 possible.

- Break below → confirms wedge breakdown, opening doors to deeper pullbacks.

- First major support – $104 825

- Confluence of the wedge midpoint and previous congestion zone; likely to attract dip buyers.

- Support band – $100 990–$97 596

- The year-to-date volume node; a typical “normal” retracement would pause here.

- Final pullback floor – $94 785

- Breach of this level risks invading the 2025-range low, shifting medium-term bias bearish.

What lies ahead

- Bearish scenario: A daily close below $111,000 could trigger stop-runs into the $100,000 area, potentially cascading into the $95,000 band before finding strong buying interest.

- Bullish scenario: Sustained support at $111 000, accompanied by rising volume, would suggest one last compression toward the wedge apex—aiming for a break above $121 000 and a possible extension toward $130 000+.

Traders should monitor the wedge trend lines, volume profile clusters, and momentum oscillators for the clearest signal of which path BTC will take next.