European producers face a threefold challenge: cheap Chinese imports, escalating US tariffs, and Big Tech’s ability to pay high power prices. These pressures could accelerate a movement away from energy-intensive primary production in favour of sustainable aluminium recycling solutions

Three Challenges for European Aluminium Producers

Transforming the aluminium industry to become greener presents both significant costs and the need for substantial investment, particularly in primary aluminium production. This creates a formidable challenge for European manufacturers, who already operate on thin margins or even face losses.

Although energy prices have eased since their peak during the Covid-19 crisis, they remain well above pre-crisis levels and are unlikely to match those of competing regions in the near future. This is especially problematic for aluminium producers, as smelting requires enormous amounts of electricity.

“For aluminium, everything comes down to electricity. Aluminium basically is electricity in solid form”

In addition to persistently high wholesale electricity prices, the industry faces challenges such as grid congestion and increasing grid tariffs, further eroding Europe’s competitive edge. While our previous article examined the financial viability of various green solutions, this one focuses on the three main challenges confronting European aluminium producers.

1. Competing with China and the US Remains A Formidable Challenge for Europe, Even in Regions Where Power Prices Are Relatively Low

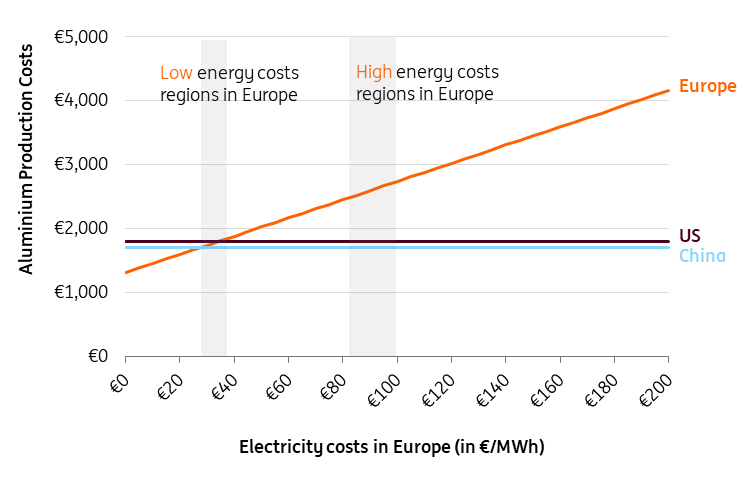

Aluminium produced in China (using cheap coal) and the US (using cheap shale gas) enjoys a significant cost advantage, with production costs around €1,800 per tonne, calculated without factoring in carbon pricing. To be on equal footing, European producers would need electricity prices to drop to between €30 and €40 per megawatt-hour. These levels are only achievable in southern countries like Spain and Portugal, which benefit from plentiful solar and wind resources, as well as the Nordic nations, which have abundant hydropower.

“The energy crisis has left Europe at a persistent cost disadvantage in the global aluminium marketplace”

Previously, such favourable electricity rates were common across northwestern Europe – including Germany, the Benelux region, and the UK. However, the aftermath of the energy crisis has seen power prices soar to between €75 and €100 per megawatt-hour, largely owing to a greater reliance on liquefied within the energy mix. Considering the many stages involved in LNG production – including extraction, liquefaction, transportation, and regasification – power prices in Europe are expected to remain higher than those in other regions, even as additional LNG capacity gradually comes online in the coming years.

Europe’s Higher Power Prices Make It Hard to Compete with Low-Cost Aluminium from the US and China

Indicative costs of primary aluminium production without carbon pricing in euros per tonne of aluminium

Production costs based on local technology costs and energy prices, without carbon pricing and tariffs. Key economic assumptions can be found in the appendix of our previous article.

Source: ING research

2. Carbon Pricing Could Level the Playing Field With China, But Not for a While

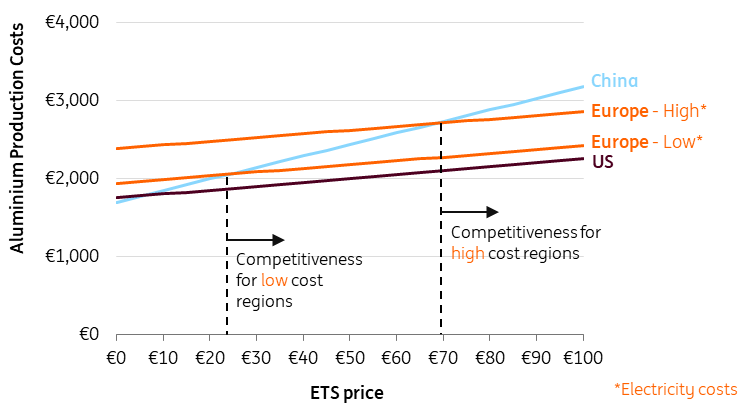

Given the current state of aluminium production in Europe, carbon pricing could be crucial in making European aluminium competitive with Chinese production. Europe’s higher power prices present a challenge, but implementing carbon pricing on both domestically produced and imported aluminium could level the playing field. Applying a cost to every tonne of CO2 produced, regardless of its origin, might make European aluminium more favourable despite its higher energy costs.

This is particularly evident when comparing the carbon footprint of aluminium production in China and Europe. Every tonne of aluminium produced in China emits three times as much CO2 as in Europe, due to China’s reliance on coal-fired power plants (approximately 15 tonnes of CO2 per tonne of aluminium in China versus just under 5 tonnes in Europe). In Europe’s regions with low power prices, a carbon price of €25-30 per tonne of CO2 would level the playing field, while the high power price regions would require a carbon price of €65-70 per tonne.

Currently, EU ETS carbon prices fall within this range for domestic production, but producers still receive significant free allowances. The complete phase-out of all free allowances and the pricing of every tonne of imported CO2 through the carbon border adjustment mechanism (CBAM) is not expected before 2034. As a result, although the gap is gradually closing, significant differences in competitiveness are likely to remain for at least the next decade.

“Despite the compelling case for taxing imported emissions, it will still take years before European producers, who generate emissions two-thirds lower than their Chinese counterparts, are shielded from Chinese imports”

Taxing From ‘Dirty’ Chinese Imports Levels The Playing Field At €25/tonne CO2 for Low Cost Regions and €70/tonne CO2 for High Electricity Cost Regions

Indicative costs of virgin aluminium production for different carbon prices

Production costs based on local technology costs and energy prices and without tariffs. Key economic assumptions can be found in the appendix or our other article

Source: ING research

Unlike with China, carbon pricing alone cannot bridge the competitive gap between European and US aluminium producers. This is because both regions share similar carbon emissions profiles for their electricity supplies, with hydropower playing a significant role in aluminium production. As a result, the introduction of carbon pricing simply raises costs on both sides proportionally, without shifting the balance of competitiveness.

Trade policy, particularly US tariffs introduced under the Trump administration, has had a more decisive impact on market dynamics between Europe and the US. In 2018, a 10% tariff was imposed on aluminium and steel imports, increasing to 25% in March 2025 and to 50% by June.

These high tariff barriers have made it virtually impossible for European – and even Chinese – producers to compete with US manufacturers in the American market. Consequently, Europe now faces the risk of an influx of inexpensive Chinese aluminium, intensifying competitive challenges for domestic producers.

3. European Aluminium Producers Are Losing To Big Tech

One of the greatest challenges facing aluminium producers today is negotiating favourable electricity rates, since energy costs make up roughly a third of aluminium’s production price. Recently, these producers have found themselves vying with technology giants for access to affordable, low-carbon power.

The surge in demand from AI-driven data centres, operated by companies such as Google (NASDAQ:), Microsoft (NASDAQ:), Meta and Amazon (NASDAQ:), has intensified electricity competition, particularly the renewable sources also sought by aluminium smelters.

Unlike aluminium manufacturers, which often operate on thin margins or even at a loss, tech firms have a far higher capacity to pay premium prices for power. As a result, European aluminium producers now face a threefold challenge: competing with cheap Chinese imports, contending with US tariffs, and struggling at home against the formidable purchasing power of Big Tech.

As demand for energy from AI-driven data centres grows, Big Tech is likely to secure its electricity needs in advance. This, in turn, gives utilities greater leverage in negotiations and is likely to drive up power prices for both Big Tech and aluminium producers. Additionally, as renewable energy sources become a larger part of Europe’s power grid, the frequency of zero or even negative electricity prices is increasing.

This results in more congestion and curtailment of wind and solar generation, which heightens risks for developers and pushes Power Purchase Agreement (PPA) prices higher – directly impacting both aluminium producers and tech giants seeking affordable, long-term contracts.

Developers’ risk is compounded by governments trying to future-proof subsidies for renewables in response to higher occurrences of negative power prices. For example, Germany has proposed reducing solar compensation when electricity prices dip below zero and is considering the adoption of two-sided feed-in tariffs, where developers must pay the government if power prices exceed certain thresholds.

These evolving policies add further uncertainty for developers who need to raise the price premium of their product. And with increasing risks, the supply of fixed-price PPAs is likely to fall, or be unaffordable, leaving aluminium producers exposed to market risk.

Recycling Provides A Solution

Recycled aluminium production in Europe offers a promising path forward: it is about 30% less expensive than primary aluminium, with costs averaging around €1,400 per tonne compared to €1,950 per tonne for newly produced aluminium. This makes recycling competitive – even against primary output from China. However, for recycling to truly solve the industry’s challenges, two key conditions must be met.

First, Europe needs to safeguard its market from an influx of cheap recycled aluminium imports from China. This “infant industry” approach is justified when fostering local, circular value chains.

Second, recycling rates for aluminium must be raised not just in Europe, but globally. Europe alone cannot fulfil its aluminium demand using only domestically sourced scrap. If primary aluminium production becomes unprofitable and ceases domestically, Europe may need to import a large amount of aluminium scrap. However, if other regions do not also boost their recycling efforts, increased demand will likely be met through higher levels of primary production to compensate for greater exports of scrap.

In that case, Europe’s recycling gain will be offset by primary production elsewhere, largely in China, where carbon emissions for aluminium are three times higher than in Europe. This would ultimately exacerbate the climate challenge, rather than alleviate it.

In summary, while Europe’s aluminium sector faces mounting obstacles, these pressures are likely to accelerate the shift toward recycling. However, realising real climate benefits will depend not only on European efforts, but also on the policies adopted by other regions.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more