Construction of AI data centers can take anywhere from six months to multiple years to complete. Accordingly, they can’t build data centers quickly enough to keep up with the demand. Accordingly, we will need new, innovative solutions to meet the demand. For example, a startup private company named Armada makes portable AI data centers for use in remote locations. Armada’s portable product is a shipping container filled with servers.

These portable data centers can be brought online in weeks, rather than months or years, as is the case with larger, permanent data centers. Portable data center solutions are not a replacement for large data centers, but a great way to meet data center needs in remote locations. Bloomberg notes that Armada is targeting the energy complex, mining, and defense industries. Per Bloomberg:

The San Francisco-based startup (Armada) is already working with Fidelis New Energy and Bakken Energy to deploy Leviathans in states including North Dakota, Texas, West Virginia and Louisiana that have available surplus power. Earlier this year Armada struck a deal to work with Microsoft (NASDAQ:) on deploying some of its pods in Saudi Arabia for Aramco (TADAWUL:).

Another benefit of these portable data centers is that they can be easily exported. Consequently, American companies can provide the world with data centers much more easily. Per one Armada investor:

America’s AI leadership hinges on owning the entire stack — from power and silicon to software — and being able to deploy it anywhere

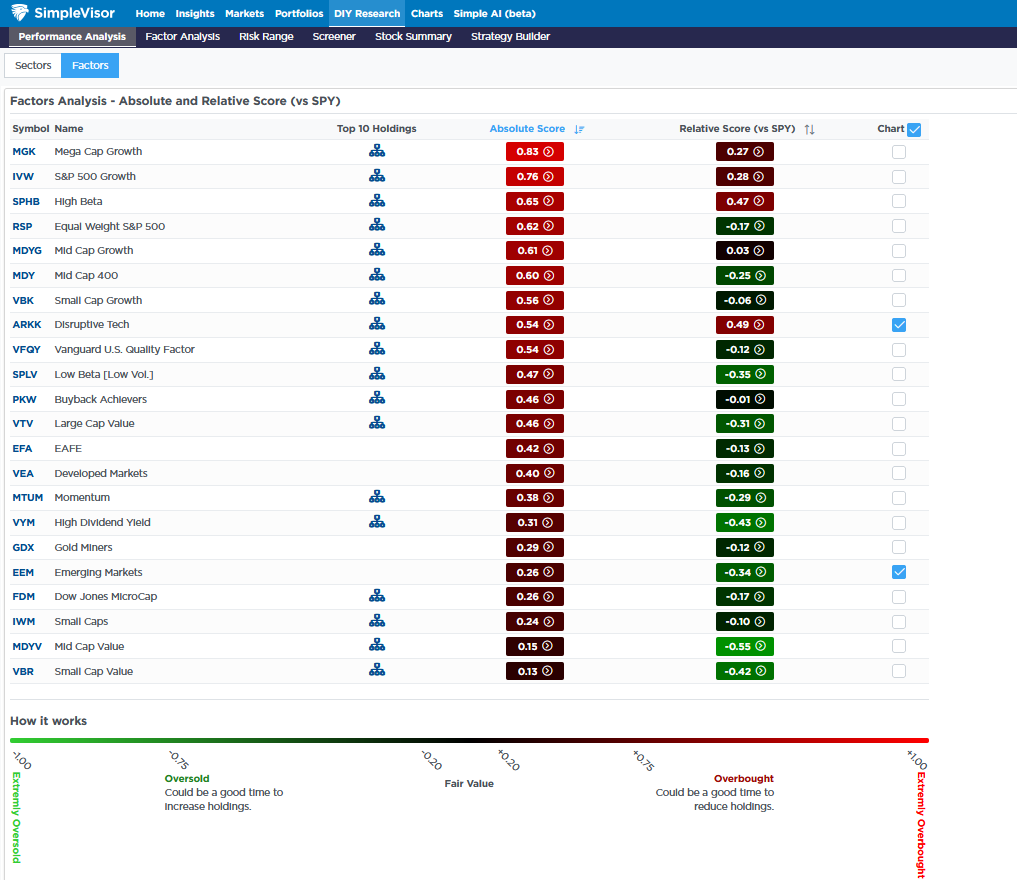

Absolute Scores Are Getting Overbought

While only a few stocks are keeping up with the broader market indexes, many stocks are becoming overbought. As shown below in the SimpleVisor graphic, most of the stock factors are overbought, with nearly half having a score of 0.50 or higher. Large-cap growth and high beta are now very overbought. It’s telling that the (RSP) is also among the most overbought.

This indicates overboughtness in the broader markets. Despite the high number of overbought factors, most are at varying degrees of oversold versus the S&P 500. For instance, the equal-weighted ETF (RSP) is very overbought (0.62), but slightly oversold versus the S&P 500 (-0.17). When this market corrects, we may see negative performance across many factors; however, a good number of factors could still outperform the market.

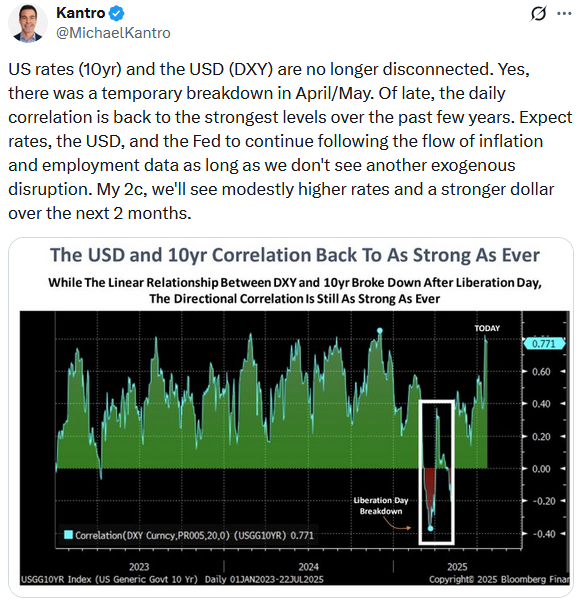

Tweet of the Day