The US has been experiencing a long “bull” stock market, that is rapid growth in stock prices, although this week tech stocks tumbled over the future prospects for US-built AI.

But could the market hit a significant downturn during Trump’s second term in the White House? At first sight this seems unlikely because it did well during his first term, from 2016 to 2020 (see chart below). However, long term trends in the US stock market reveal a pattern suggesting that stock prices might be quite vulnerable during his second term.

The Nobel prize-winning economist, Robert Shiller, who studies financial markets thinks that the US stock market has peaked, and future returns will be much more modest than in recent history although he does not suggest that a crash is on the horizon.

The market under different presidents

Shiller’s data makes it possible to look at the relationship between who is the president and stock prices since 1925. By examining the performance of the stock market over that period we can identify the extent to which eight Democrat and nine Republican presidents have influenced the growth of the market.

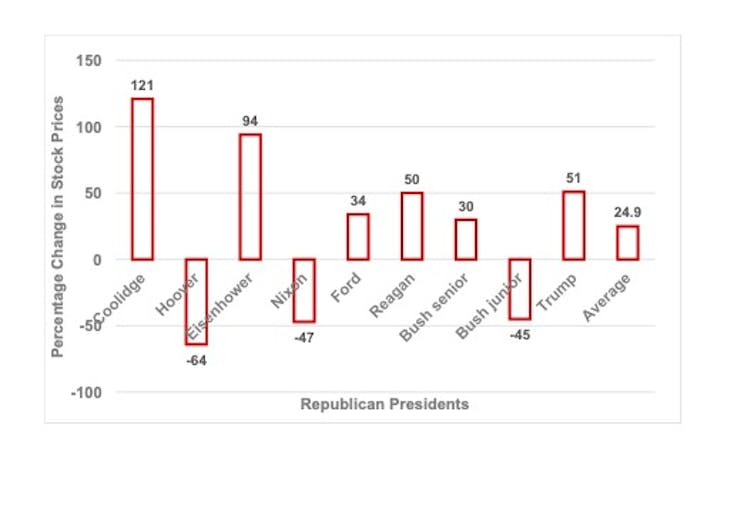

Changes in stock prices during Republican presidents 1925 to 2024:

Author provided (no reuse)

The chart shows the percentage changes in the Standard and Poor’s monthly stock price index (which gives a snapshot of the market), corrected for inflation, during the incumbencies of Republican presidents since January 1925.

The average increase in stock prices for Republican presidents was 25%. But the thing that stands out in the chart is that three major crashes in the stock market also took place under these Republicans incumbents.

The first of these, known as the Wall Street Crash, occurred on October 28 1929 when Herbert Hoover was president. This was the trigger event for the Great Depression of the 1930s and resulted in a fall of 64% in the stock market during his presidency.

His reaction to the crash (when share values fell dramatically) was to do nothing in the belief that the economy would eventually recover on its own. This cost him the 1932 presidential election when Democrat Franklin D. Roosevelt was elected for the first time. He was subsequently elected a record four times, thanks to his New Deal policies for dealing with the crisis.

À lire aussi :

DeepSeek: how a small Chinese AI company is shaking up US tech heavyweights

The second crash occurred during Richard Nixon’s incumbency. He would have been impeached by Congress had he not resigned in August 1974 following the revelations of the Watergate scandal.

This occurred when the White House employed burglars to break into the Democrat party headquarters in the Watergate building in Washington DC. Once Nixon’s attempt to spy on his opponents became public he was forced to resign and overall the stock market fell by 47% during his incumbency.

The third crash occurred in December 2007 when George W Bush was the president. It had its origins in the deregulation of the financial sector which had occurred in the US after Ronald Reagan became president in 1980. Lax financial regulations led to ever increasingly risky assets and trading practices on Wall Street starting in the real estate market.

The crisis spread rapidly throughout the world’s financial system and a recession of the scale of the 1930s was only averted by prompt action by the Federal Reserve chairman, Ben Bernanke, who worked with political leaders in other countries such as UK prime minister Gordon Brown to stabilise the system. The stock market fell by 45% during Bush’s period of office.

Many factors are at work to explain this, but the overriding fact is that Republicans are less likely to regulate the financial sector, or across the board, than Democrats. Their voters are more likely to be optimistic about the prospects for the economy, and therefore to take risks when investing in the stock market, when a Republican is in the White House.

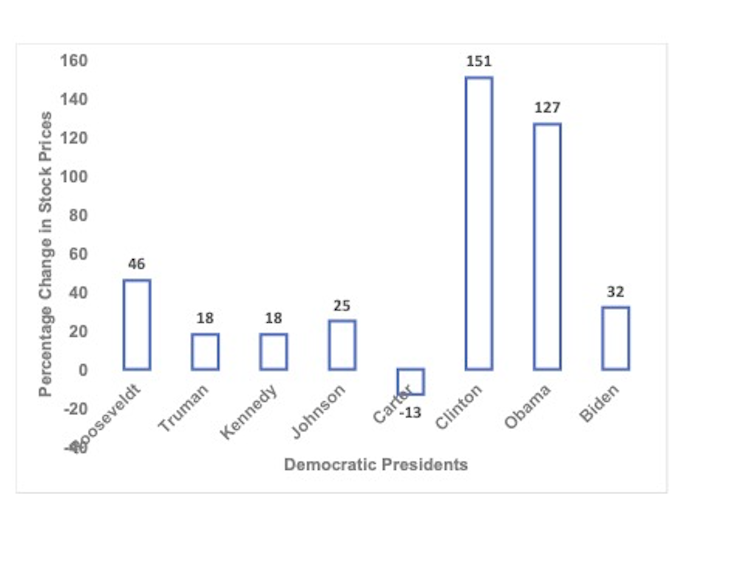

Changes in stock prices during Democratic presidents 1925 to 2024:

Author provided (no reuse)

The second chart shows changes in stock prices during the incumbencies of eight Democratic presidents during this period. It is very different from the Republican chart, since, of those presidents shown, only Jimmy Carter left office with the stock market lower than when he arrived, and that by a modest 13%.

Bill Clinton was the most successful president, achieving an increase of 151% during his two terms in the White House. Overall, the stock market rose by an average of 51% during Democrat incumbencies, more than twice the size of the Republican increases.

These results are surprising given that the Republicans are the traditional party of big business and so might be expected to be good for the stock market.

Donald Trump has promised to increase tariffs on imports from the rest of the world, particularly those from China. In addition, there is a burgeoning budget deficit caused by the gap between spending and taxation.

Most economists think these policies will create inflation and slow growth.

Many investors are currently quite nervous about a possible recession after the long bull market of the last few years. The drop in the price of tech stocks this week confirms this. One effect of this has been to cause a rise in yields on US Treasury long-term bonds, reflecting fears of further inflation.

Recent comparative research shows that countries can pay a high price for populist economic policies. So, it would be well worth Trump studying the history of US stock markets rises and falls, if he wants to avoid a severe economic downturn during his second term.