Key Takeaways

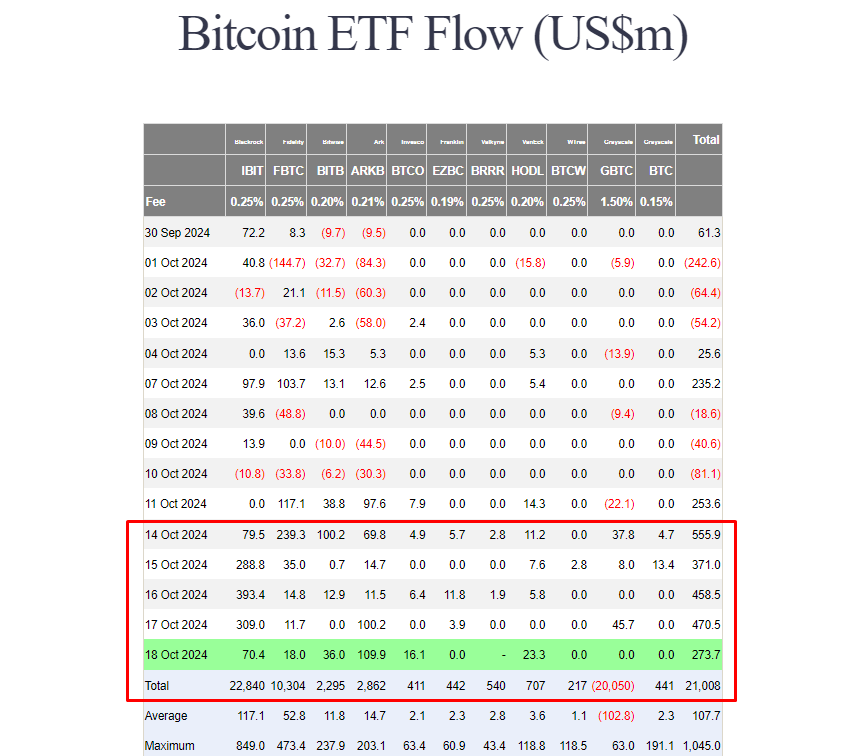

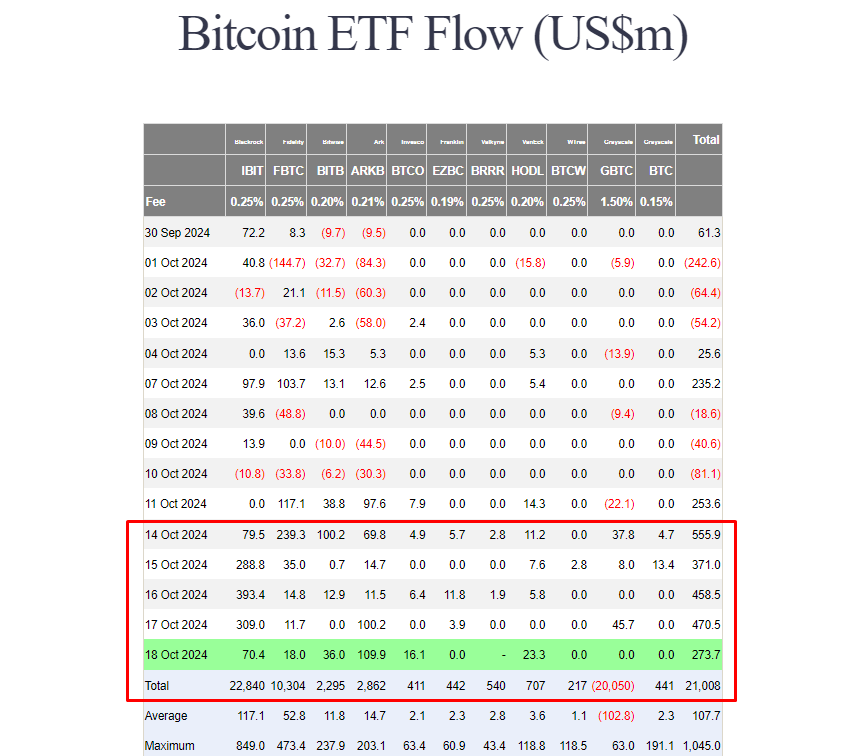

- Bitcoin ETFs reached a total of $21 billion in net inflows, a record high.

- ARKB and IBIT were the top performers, significantly contributing to the week’s gains.

Share this article

US spot Bitcoin ETFs reached $21 billion in total net inflows on Friday as investor appetite for these funds remains strong. According to data from Farside Investors, these ETFs collectively netted over $2 billion this week, extending their winning streak to six consecutive days.

Yesterday alone, spot Bitcoin ETFs, excluding Valkyrie’s BRRR, attracted around $273 million in net purchases. ARK Invest’s ARKB led the group with nearly $110 million.

BlackRock’s IBIT also logged over $70 million in net inflows on Friday, followed by VanEck’s HODL, Bitwise’s BITB, Fidelity’s FBTC, and Invesco’s BTCO.

IBIT and ARKB were the top-performing Bitcoin ETFs this week. ARKB experienced a surge in inflows, surpassing $100 million on both Thursday and Friday.

Meanwhile, half of the group’s inflows came from IBIT. As of October 18, its net inflows have topped $23 billion, solidifying its position as the world’s premier Bitcoin ETF.

With Friday’s positive performance, Bitcoin ETFs saw their first week with no negative inflows. Even Grayscale’s GBTC, known for its historical outflow reputation, reversed the trend with over $91 million in net inflows.

Bitcoin ETF options to deepen liquidity and bring in more investors

On Friday, the SEC approved NYSE and CBOE’s proposals to list options for spot Bitcoin ETFs. While the exact launch date has yet to be determined, ETF experts say the approval will expand market access to crypto-related financial products on major US exchanges.

Nate Geraci, president of the ETF Store, sees options trading on spot Bitcoin ETFs will increase liquidity around Bitcoin ETFs, attract more players to the market, and thus make the whole ecosystem more robust.

“In terms of the potential impact here, I think that options trading on spot Bitcoin ETFs is decidedly good. Because all options trading is going to do is deepen the liquidity around spot Bitcoin ETFs,” said Geraci, speaking in a recent episode of Thinking Crypto. “It’s going to bring more players into the space, I would say especially institutional players. To me, it just makes the entire spot Bitcoin ETF ecosystem that much more robust.”

According to Geraci, options trading is important for institutional investors in hedging and implementing complex strategies, especially with a volatile asset like Bitcoin.

The ETF expert suggests that retail investors, in addition to institutional players, are eager to access options trading for the same reasons.

“Even when we look over to the retail side, with more sophisticated retail investors, they want options trading as well for the same reason,” Geraci stated.

Share this article