Bitcoin is at a critical turning point after the Federal Reserve’s interest rate cut over three weeks ago.

The price is above the $65,000 mark, setting the stage for a potential push to new highs. Market sentiment is increasingly optimistic, with many expecting a significant Bitcoin rally in the coming weeks.

Key data from CryptoQuant supports this bullish outlook, revealing that new investors are starting to buy BTC again. This influx of fresh capital is a positive sign for the market and could indicate further gains as demand rises.

Historically, new investors’ accumulation periods often precede major price surges, adding to the excitement surrounding Bitcoin’s next move.

With the broader market showing signs of recovery and BTC leading the charge, the coming days will be crucial. Investors and analysts alike are watching closely to see if this momentum can be sustained and lead to a breakout to new all-time highs.

Bitcoin Demand Signals A Positive Trend

Bitcoin is experiencing a wave of optimism following last week’s impressive surge from $58,800 to its current level of $65,600. This translates into a robust 12% increase, reigniting positive sentiment across the cryptocurrency market.

Investors and analysts hope this momentum can be sustained, potentially leading to further gains in the weeks ahead.

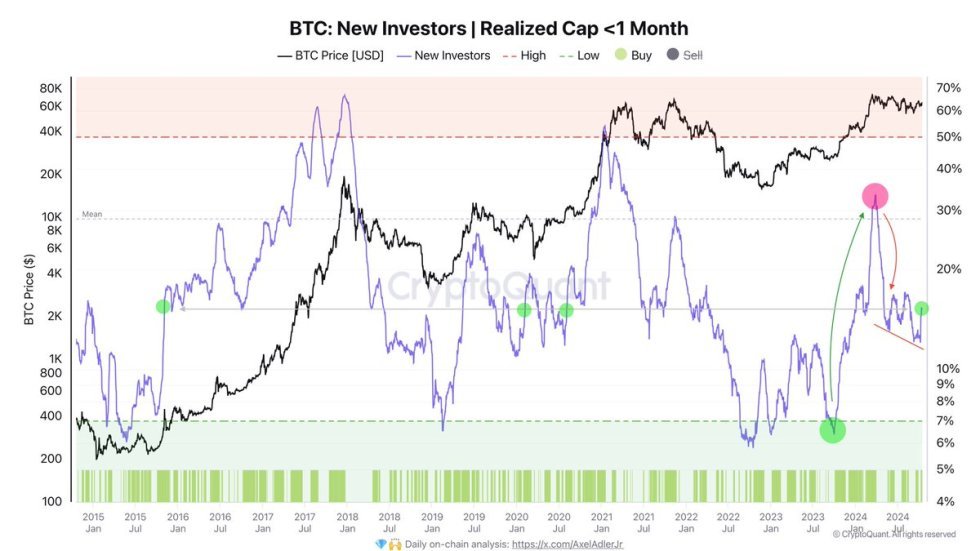

Top analyst and investor Axel Adler has highlighted a compelling chart from CryptoQuant. The chart reveals that demand for BTC purchases from new investors has resumed, showcasing a 3% increase over the last 10 days.

This uptick in new investment activity is crucial, as it indicates a growing interest in Bitcoin from fresh market participants. The chart further illustrates that the realized cap for new investors with fewer than one-month-old is currently reactive, suggesting a favorable environment for price appreciation.

The return of new investors is a significant signal for the market, as increased demand often precedes price rises. Historically, when new participants enter the market, it can lead to a supply-demand imbalance that drives prices higher.

As these new investors accumulate BTC, their collective impact could result in upward price pressure, reinforcing the bullish sentiment.

With Bitcoin’s recent price action and the influx of new capital, the outlook for the cryptocurrency remains positive. As investors monitor market developments, the potential for a continued rally appears promising, making BTC an exciting asset in the coming weeks.

Key Prices To Watch

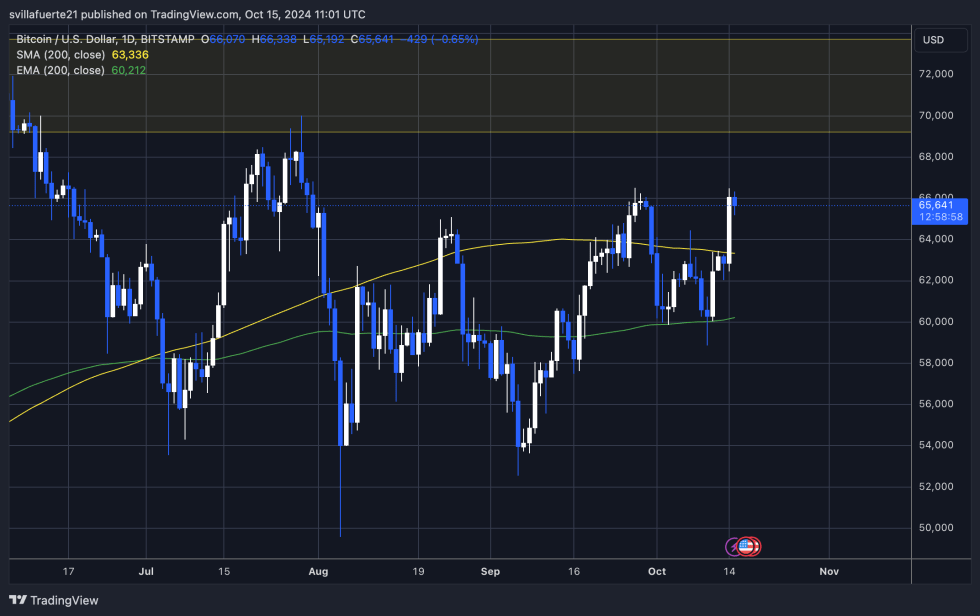

Bitcoin is trading at $65,600 after a notable 5% surge yesterday, reflecting renewed optimism in the market. The price is currently testing local highs at $66,500 while holding strong above the 200-day moving average (MA) at $63,336, a positive sign for bullish sentiment.

BTC must break above the $66,500 resistance level for a confirmed rally to new highs and aim for a new target of around $70,000. This pivotal price point will significantly influence the market’s direction in the coming weeks.

However, if BTC fails to surpass the $66,500 mark, a retracement may occur as the price seeks strong demand levels to push back upward. The next demand level to watch is around $62,000. Should the price drop below this level, it could trigger a deeper correction to approximately $59,000, raising concerns among traders and investors.

Market participants closely monitor the price action to gauge whether BTC will continue its upward trajectory or face potential setbacks. The coming days will be crucial in determining Bitcoin’s path forward as it navigates these key resistance and support levels.

Featured image from Dall-E, chart from TradingView