Aug 26 (Reuters) – With interest rate cuts virtually locked in, investors are ramping up their focus on economic data over the next few months as they game out whether the “soft landing” narrative that has helped drive U.S. stocks in 2024 can continue.

“What the market wanted was to hear that the rate-cutting cycle is starting,” said Alessio de Longis, senior portfolio manager and head of investments at Invesco Solutions.

However, “is the Fed telling us that they’re actually worried about the economy now? And if that is the case, maybe the excitement about the cutting cycle should take a different perspective.”

History shows that stocks tend to perform far better when rate cuts come against a background of resilient growth instead of during a sharp economic slowdown. Since 1970, the S&P 500 has climbed an average of 18% one year after the first rate cut in non-recessionary periods, according to Evercore ISI strategists. In recession periods, the index climbed an average of just 2% a year following the first cut.

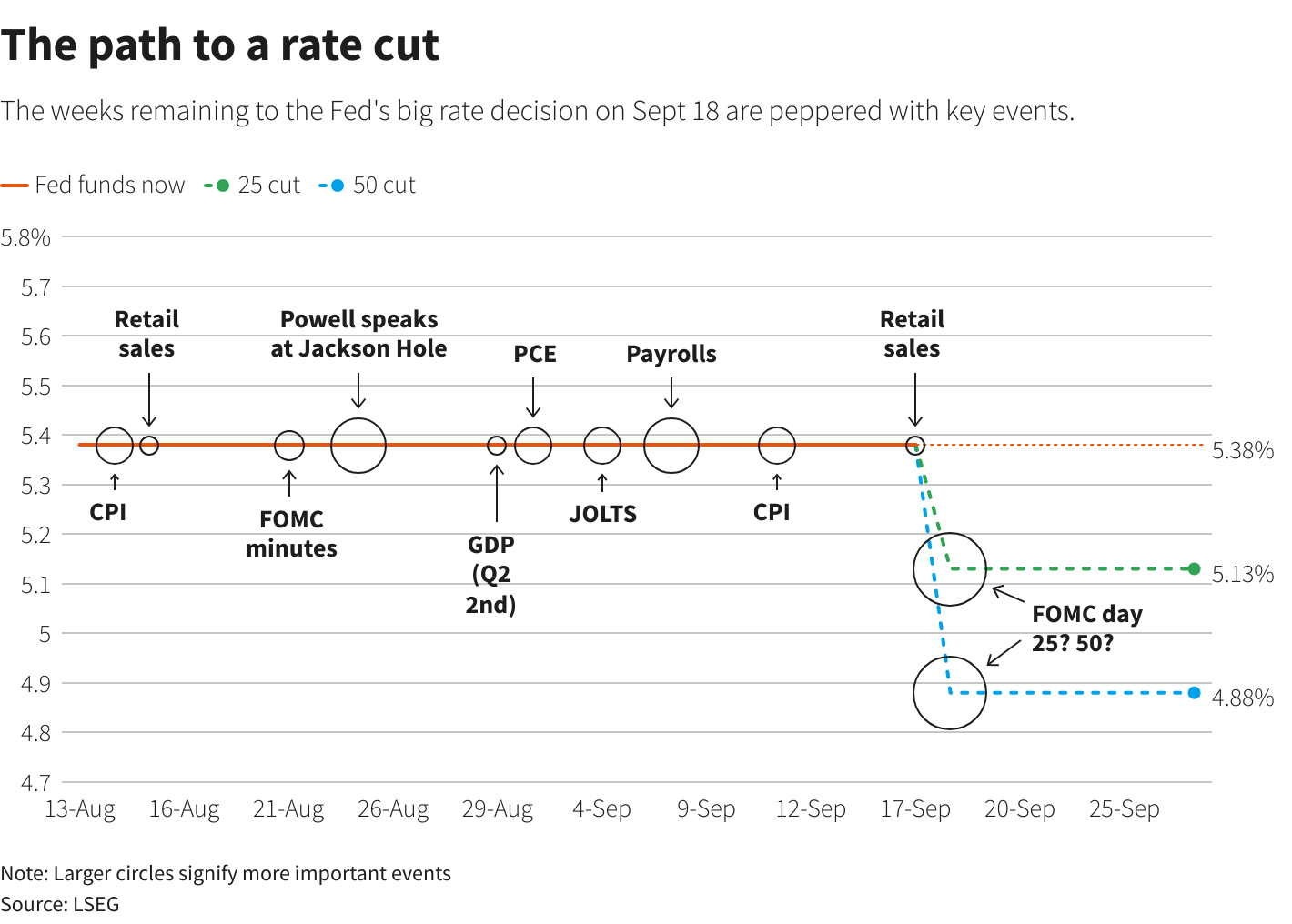

Other important upcoming data includes two monthly inflation reports: the personal consumption expenditures price index on Aug. 30 and the consumer price index on Sept. 11.

More signs of economic weakness could once again rattle stocks and shift expectations toward a 50 basis-point cut next month. Expectations for such a move were priced at around 35% on Friday afternoon, compared with about 29% before the speech, with the remaining expectations for a 25-bp cut, futures data showed.

“The Fed is easing with the economy not particularly weak (and inflation still above target), and it has the potential to ease substantially in response to any acute weakness,” wrote Rick Rieder, BlackRock’s chief investment officer of global fixed income, in a note on Friday.

Quincy Krosby, chief global strategist at LPL Financial, said a key factor for stocks is whether rate cuts are coming because inflation is moderating or because of weakening in the labor market.

“The market wants a rate-cutting cycle introduced because inflation is coming down,” Krosby said. “The question remains as to whether or not we see more deterioration in the labor market.”

Encouraging data could also help bolster stocks in a period that some expect could bring turbulent trading. September is historically the weakest month for stock performance, with the S&P 500 averaging a 0.78% decline since World War Two, according to data from CFRA.

Elevated stock valuations may also make investors less willing to hold on to equities if bad news hits. The forward price-to-earnings ratio for the S&P 500 is at 21, up from 19.6 in early August, according to LSEG Datastream. The index’s long-term average is 15.7.

“The longer-term trends in stocks are rock-solid and any weakness is an opportunity to add exposure,” said Andre Bakhos, managing member at Ingenium Analytics LLC. In the shorter term, “we’re going to get … choppy, erratic, volatile moves because no one really knows what happens now that he has (Powell) shown his hand.”

Sign up here.

Reporting by Lewis Krauskopf in New York; additional reporting by Bansari Mayur Kamdar in Bengaluru; Writing by Ira Iosebashvili; Editing by Matthew Lewis

Our Standards: The Thomson Reuters Trust Principles.