- Bitcoin noted sustained demand from institutional investors with nearly $13 million inflows in a week, per IntoTheBlock data.

- The US government moved $600 million in Bitcoin, not for intent to sell, but for custody through a partnership with Coinbase Prime.

- Bitcoin hovers around $60,000 on Sunday, erasing nearly 2% value in the last seven days.

- BTC could extend gains by 12% and rally to $67,000, a key resistance for the asset.

Bitcoin (BTC) hovers around key psychological support at $60,000 on August 18, at the time of writing. Data from IntoTheBlock shows that Bitcoin Exchange Traded Funds (ETFs) recorded nearly $13 million in net flows during the week.

Inflows to ETFs show sustained demand among institutional investors, likely to catalyze gains in Bitcoin.

Bitcoin could rally for these reasons

Key developments from last week include BTC fees reaching a yearly low for the third consecutive week, as crypto markets continued to stabilize post the market crash. Data from IntoTheBlock shows that the net inflows to crypto exchanges were $418 million, including the US government transfer to Coinbase Prime.

The transfer by the US government was not with the intent to sell but to transfer to Coinbase Prime, through an official partnership. IntoTheBlock analysts note that even as BTC suffered a decline in its price, demand from institutional investors was sustained, evident from nearly $13 million inflows to ETFs.

BTC could extend gains by 12%

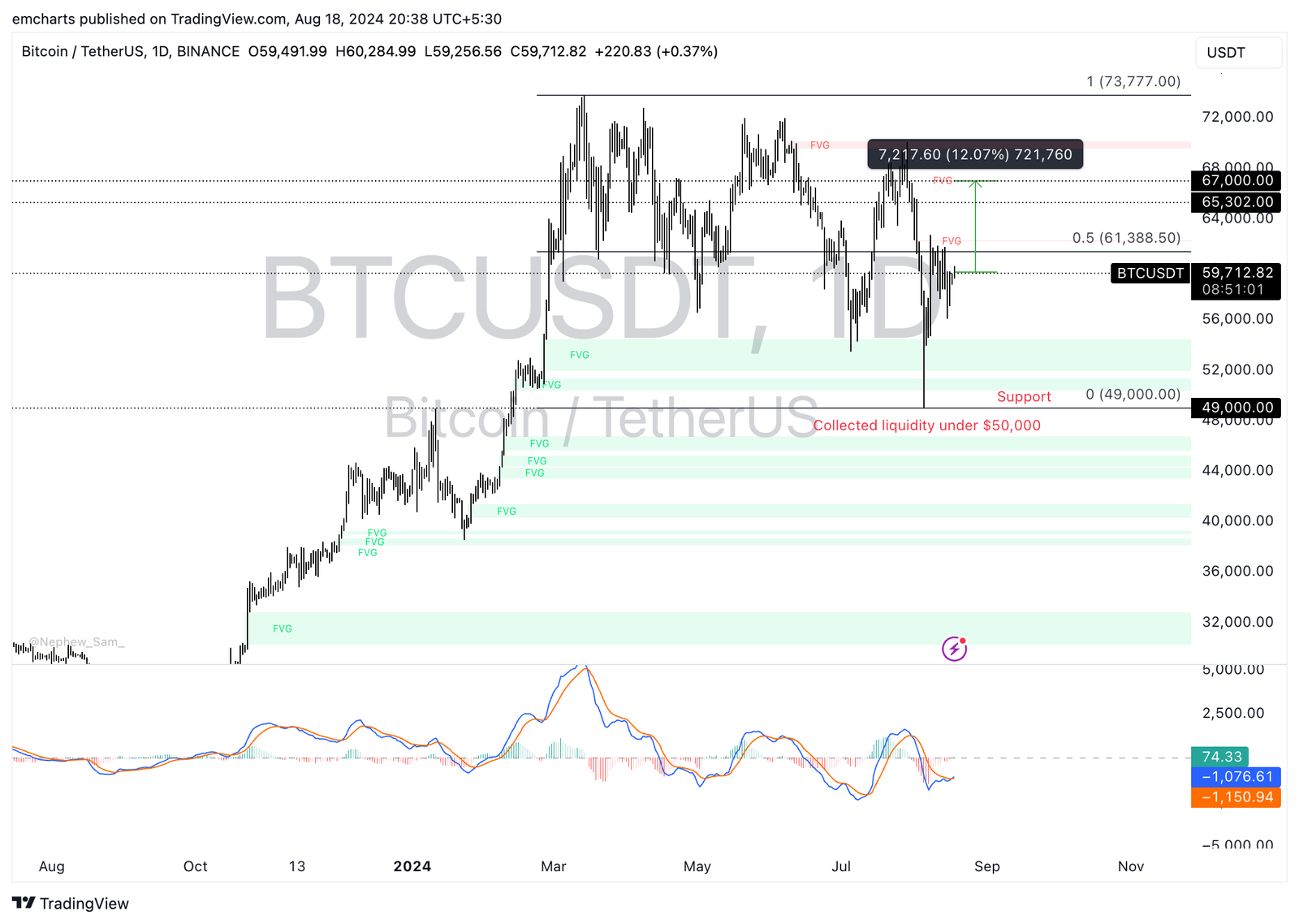

Bitcoin hovers around key psychological level of $60,000. BTC could extend gains by over 12% and rally to the Fair Value Gap (FVG) at $67,000. The largest asset by market capitalization faces resistance at $61,388, the 50% Fibonacci retracement of the decline from the March 14 top of $73,777 to the August 5 low of $49,000.

The Moving Average Convergence Divergence (MACD) indicator shows underlying bullish momentum in Bitcoin price trend.

BTC/USDT daily chart

Looking down, Bitcoin could sweep liquidity at the Fair Value Gap between $50,368 and $51,300.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin’s market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.