A significant shift is on the horizon—the potential ‘financialization’ of Bitcoin through the introduction of options on spot Bitcoin exchange-traded funds (ETFs). This move could herald a new era for Bitcoin, aligning it closer to the operational dynamics of traditional financial markets.

Spot Bitcoin ETF Options Coming Soon?

Recent activities may indicate significant strides towards the approval of spot Bitcoin ETF Options. Notably, key market players such as NASDAQ, NYSE, and CBOE have retracted their initial filings. While CBOE already submitted a more detailed application shortly thereafter, NASDAQ and NYSE are expecting to follow suit.

James Seyffart, a Bloomberg ETF analyst, remarked via X. “NASDAQ & NYSE have joined CBOE in withdrawing their applications for allowing options to trade on the Bitcoin ETFs. I’m expecting them to re-file over the coming days or weeks like we saw from CBOE,” Seyffart stated.

He further explained that the revised application from CBOE expanded significantly from a mere 15 pages to a robust 44 pages, suggesting substantive feedback from the SEC, potentially addressing concerns related to position limits and the risk of market manipulation.

This refiling indicates a reset in the review process, with Seyffart hinting that the new deadline could be pushed to around April 25, although the exact timeline may remain flexible depending on the depth of SEC engagement.

“No way to know for certain if SEC is engaging with CBOE on this. One downside here is that I think this restarts the clock. So deadline would move to some time at the end of April (Apr 25th-ish). But if SEC is engaging — the deadline might not actually matter? Time will tell,” Seyffart wrote.

The Financialization Of Bitcoin

According to Kelly Greer, Vice President of Trading at Galaxy Digital, the decision to list options on Bitcoin ETFs marks a pivotal moment for the market. Greer emphasized the transformative impact of derivatives on market functionality on X, noting that “Listing options on BTC ETFs is a more important milestone than you think. Derivatives are the foundation of functional markets, and BTC and digital assets have a ways to go to catch up to traditional markets.”

Greer highlighted the current disparity in the derivatives market, pointing out that while derivatives in traditional markets like equities and commodities can be 10 to 20 times the size of the underlying market capitalization, this ratio is starkly inverted in Bitcoin. She noted, “In BTC where listed options value is less than 2% of BTC’s market cap, options open interest stands at $20 billion, with an additional $2 billion from the CME not included in this count.”

“Centralized exchange listed perpetual open interest is at $16 billion versus a spot market cap of $1.2 trillion,” she elucidated on the access challenges that curb broader market participation, particularly impacting US retail investors who form a significant portion of equity options markets but are largely excluded from similar opportunities in Bitcoin due to regulatory constraints.

Greer conveyed the strategic importance of the US financial market, “US equity markets are the largest, most liquid markets in the world, comprising 44% of the global $109 trillion equity market as of the fourth quarter of 2023. Listing options on ETFs listed here opens up the floodgates to the largest market makers and deepest liquidity pools possible to enable hedging and capital efficiency for BTC market participants.”

“Meltem Demirors and Kaledora Fontana Kiernan-Linn recently made a compelling case for financialization here, explaining how this was critical for the growth of the oil industry and will be for new digital commodities, btc being the mother of them all,” Greer remarked.

Demirors, former Chief Strategy Officer at CoinShares, stated via X, “Financialization is a beautiful thing. The advent of oil futures and derivatives markets enabled companies across the value chain to hedge and market makers to speculate on directional pricing. Today, trading is a big driver of oil and gas company profitability.”

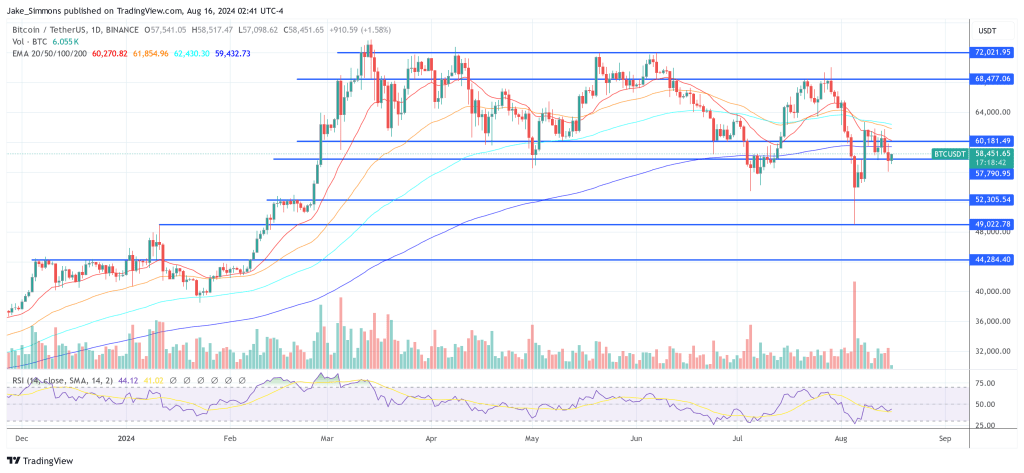

At press time, BTC traded at $58,451.

Featured image created with DALL.E, chart from TradingView.com