The Asian Development Bank’s Trade (ADB) and the International Finance Corporation (IFC) have jointly published a Reference Note to better define sustainable trade finance and set eligibility criteria for related deals.

The role of trade finance in facilitating the trade of goods and services essential for climate change mitigation and adaptation is critical. As such, the two institutions issued the Reference Note: Sustainable Trade Finance as a step towards establishing a universally recognised definition of “sustainable/climate trade” finance.

ADB’s focus on trade as a key component of climate action highlights the role of trade finance in supporting sustainable development.

Sustainability is a vital aspect of the global trade industry. The global supply chain’s Scope 3 emissions account for nearly 80% of greenhouse gas emissions.

While it is a difficult problem to face, and one that will require collaboration across all levels, it is vital that the industry tackles the problem head-on.

TFG heard from IFC and ADB about the indispensable role of multilateral development banks (MDBs) in leading the industry towards more sustainable trade. By providing essential resources and support, MDBs not only assist businesses but often pioneer new market areas by creating a demonstration effect in various sectors and encouraging private capital engagement.

Motivations and objectives behind the Reference Note

The primary motivation behind the ADB and IFC Reference Note on sustainable trade finance is to standardise and promote sustainable trade practices across global markets. This initiative aims to facilitate access to financing programs and solutions linked to sustainable trade by setting clear criteria for what constitutes sustainable trade transactions.

The Reference Note is a response to the increasing need in the marketplace to standardise definitions and clarify which deals are classified as sustainable, therefore unlocking additional pools of financing.

Defining sustainable trade

The Reference Note defines sustainable trade as trade activities that have a positive environmental, social, and economic impact. This includes the promotion of low-carbon technologies, energy-efficient equipment, and sustainable agricultural practices.

Eligibility criteria

The eligibility criteria for sustainable trade deals include the following:

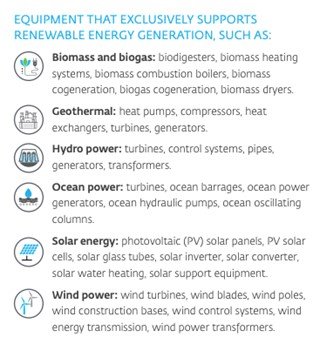

- Equipment that exclusively supports renewable energy generation.

- Energy efficient equipment and goods.

- Agricultural commodities with sustainability certifications.

- Goods and equipment that support circular economy.

Source: Reference Note: Sustainable Trade Finance

Support and resources

ADB and IFC offer various forms of support to businesses and financial institutions aiming to engage in sustainable trade. This includes financing options, technical assistance, and policy advice. The organisations also provide resources to help businesses demonstrate the sustainability of their trade activities and meet the established criteria.

Steven Beck, Head of Trade and Supply Chain Finance Asian Development Bank said, “With global trade and supply chains linked to 80% of global carbon emissions and facing a wide range of sustainability challenges, regulators, investors, and consumers increasingly demand businesses to develop trade that is sustainable.

This reference note will help financial institutions, manufacturers, producers and other stakeholders to better define sustainable trade and eligibility requirements for sustainable trade deals, subject to review of detailed circumstances by ADB or IFC.”

However, ADB’s support of sustainability for banks does not end here.

They are currently developing a pilot to assist banks in identifying sustainable transactions in their criteria based off of this paper, which will be completed in September 2024, with a goal to launch to the wider market by 2025.

Nathalie Louat, Global Director of Trade and Supply Chain Finance at International Finance Corporation, said, “MDBs play a crucial role in boosting trade by providing financing, technical expertise, and policy advice to support countries and financial institutions to overcome trade barriers, promote sustainable trade practices, and achieve their development objectives.

The standardized definitions and criteria for sustainable trade can support inclusive growth, ensuring the benefits of increased prosperity are shared broadly across societies. We hope other MDBs will joint this initiative.”

Though the Reference Note is a good starting point to continue to support sustainable growth, it was not the first, nor will it be the last initiative.

In fact, IFC introduced the concept of Sustainable Trade in 2010 as an incentive for participating banks in its Global Trade Finance Program (GTFP) to facilitate cross-border trade of sustainable equipment and raw materials that support climate change mitigation and resilience activities (e.g., renewable energy, energy efficiency, climate-smart agriculture, green transport, green buildings, etc.).

Since its inception, IFC has not only supported more than $7.5 billion in climate trade deals but has also expanded its climate-smart initiative to other trade programmes.

Now, the hope is that the join ADB and IFC Reference Note will continue to encourage the industry to continue the momentum for sustainability.

ADB and IFC’s support can serve as a case study for MDB’s success in facilitating sustainable trade.

ADB highlights how trade can drive climate action by promoting environmentally friendly practices and providing the necessary financial instruments to support these initiatives.

For instance, the use of green bonds and sustainability-linked loans can incentivise businesses to adopt sustainable practices.