- Whale wallets accumulated over 7 million BTCs

- Cryptocurrency has stayed above $66,000 despite declines on a few fronts

Bitcoin whale wallets have been consistently accumulating BTC over the years, hitting a record level of holdings recently. Simultaneously, BTC has reclaimed a price level from which it had previously declined, indicating potential recovery or stabilization in its market price.

An increase in the number of new addresses has accompanied this resurgence in price too.

Bitcoin whale wallets hit a milestone

According to data from IntoTheBlock, Bitcoin whales have reached a significant milestone in their accumulation efforts. The balance of wallets holding 1,000 or more BTC has climbed to over 7.9 million Bitcoins.

If calculated at the current market rate, these holdings would be valued at nearly $529 billion. This amount represents a significant portion of Bitcoin’s total market capitalization, which stands at over $1.3 trillion.

This level of accumulation is noteworthy since it is yet to be seen in the last two years, indicating a significant hike in holdings from these wallets.

Such a trend means that these major investors are either holding onto their positions with more conviction or actively accumulating more BTC. Either way, it is betting on its long-term value, despite any short-term market volatility.

Slight spike in new Bitcoin addresses

The aforementioned data analysis also pointed to a positive trend in Bitcoin’s network, one marked by both the growing holdings of Bitcoin’s whale wallets and a hike in the number of daily new addresses.

After recording a sharp decline on the charts, the number of new Bitcoin addresses began to rise around 13 July, from approximately 244,578 to nearly 291,000.

This uptrend in new address creation is a sign of renewed interest or influx of new participants. The growth in new addresses can contribute to greater network activity and liquidity, which could lead to stronger price trends.

These trends, when viewed alongside significant accumulation by Bitcoin whales, provide a picture of the market’s current state.

While large holders have continued to consolidate their positions, signaling confidence in BTC’s long-term value, new users entering the market can add trading volumes.

BTC moves into a new price zone

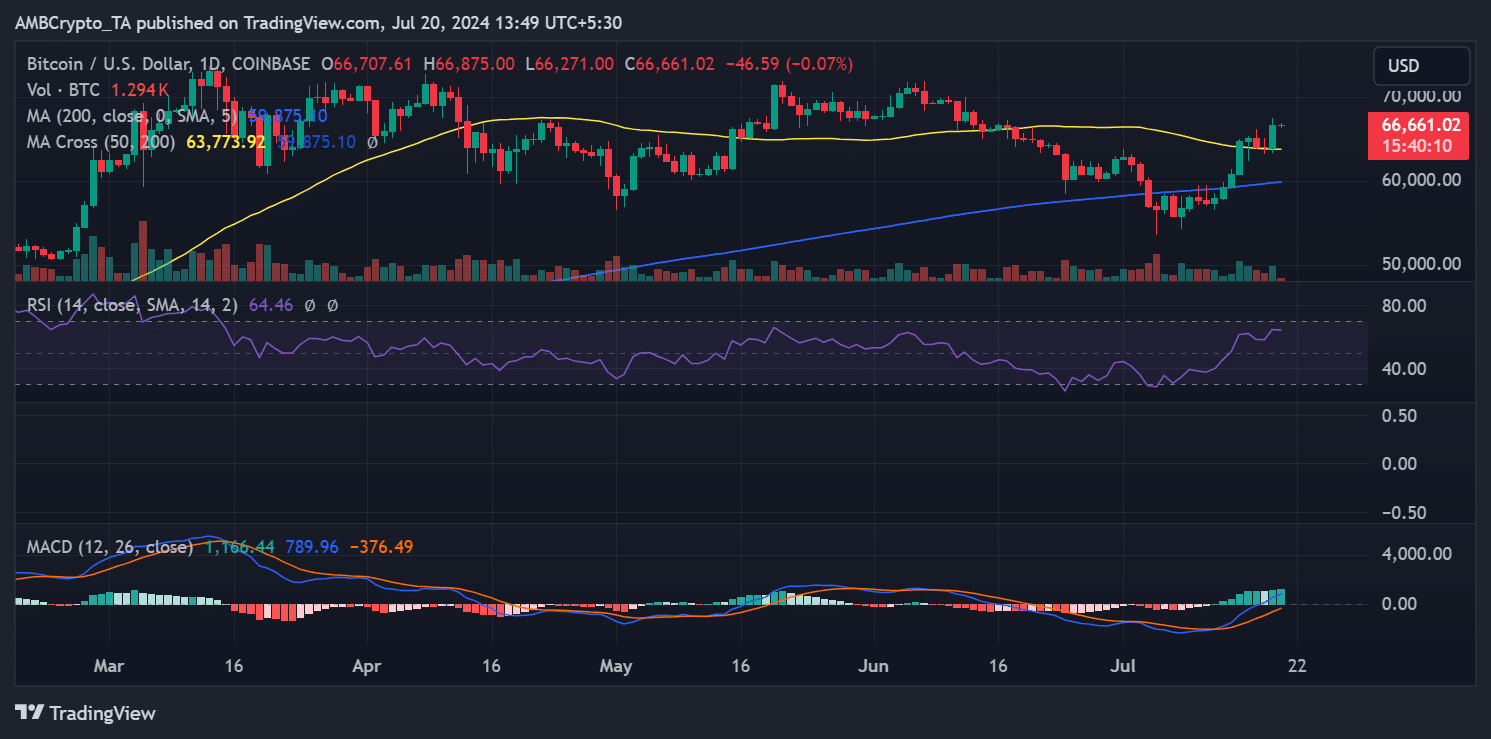

Another analysis of Bitcoin’s price trend revealed a significant uptick at the end of the trading session on 19 July, with an appreciation of over 4%. This uptick elevated the cryptocurrency from around $64,000 to $66,000 on the charts.

– Read Bitcoin (BTC) Price Prediction 2024-25

As a result of this price surge, the value of Bitcoin held in whale wallets — Those holding 1,000 or more BTC — increased, hitting an approximate total of nearly $529 billion.

Here, it’s worth pointing out that although there has been a slight decline in Bitcoin’s price since this peak, it has since managed to maintain its position within the $66,000-range.